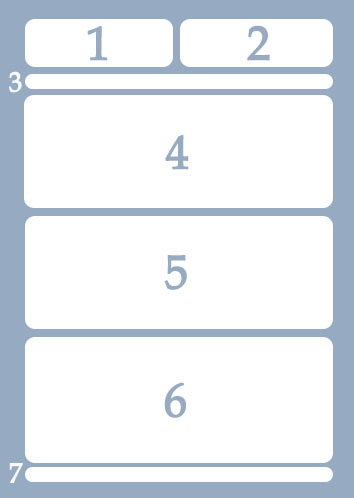

*The sections of the payroll can be presented in this format or another, this is the most common.

Do you want to learn how to read a payroll? The payslip is the receipt that a company issues for the worker, where it accredits the payment of the different amounts of money that make up the worker’s salary.

Below we explain the parts of a payroll:

- Company data: Tax name, address, N.I.F. and Social Security contribution code.

- Worker data: Full name, N.I.F, Social Security affiliation number, job, category, contribution group and date of seniority.

- Settlement period: Period that runs from the first day to the last day that covers the salary specified in this payslip.

- Accruals (Sum)

- Salary perceptions

- Base salary: Remuneration established by the collective agreement.

- Extraordinary bonuses: This is what is known as extra payment, they can be prorated during the 12 months of the year or be paid in a specific month.

- Salary supplements: A concept that remunerates the worker’s work, they can be given by the collective agreement, as compensation for the quantity or quality of the work or granted by the company on a voluntary basis.

- Non-salary payments

- Compensation: Payment that the company makes to the worker for expenses that he or she may have incurred due to work.

- Social Security benefits and compensation: Measures put into operation by the Social Security for worker’s situations.

- Other perceptions

- Salary perceptions

- Deductions (subtracted)

- Worker contributions to Social Security contributions and joint collection concepts:

- Common contingencies: Social Security contributions for various items.

- Unemployment: Social Security contributions for unemployment purposes.

- Vocational training: Social Security contributions for various training items

- Overtime due to force majeure: Contribution generated by overtime due to force majeure (2%)

- Other overtime: Contribution generated by overtime

- I.R.P.F: Amount on Personal Income. This is the financial advance corresponding to the Income Tax Return.

- Salary advances: An advance of money from the salary is reflected in the event that the worker has requested it and it has been granted.

- Other deductions.

- Total liquid to be perceived: The sum of all the parts of point 4 – the sum of all the parts of point 5. This is the amount that will be paid to the worker.

- Worker contributions to Social Security contributions and joint collection concepts:

- Determination of contribution bases: The explanatory table for the calculation of deductions is shown. It is an informative section.

- Overtime (total overtime worked during the period), signature and seal of the company.